Is the Crypto Move in 2023 Telling Us Something?

By all accounts, 2022 was a difficult year for financial markets with all of the major indices down for the year and as interest rates went up, speculative and leveraged markets saw large pullbacks. As we move into the new year, we have seen inflation expectations dropping, giving some support to markets.

A few weeks into 2023, and the S+P, Dow and Nasdaq are all up for the year an average of 4.78%. Gold is also up 5.98% as markets have collectively breathed a sigh of relief as interest rate expectations have tapered off.

The stand out this year, however, is crypto with Bitcoin up 37.65%, Ethereum up 34.48%, and many other tokens up even more.

What prompted this rally? Unlike countries which will see currencies rise and fall on the back of interest rate expectations and growth outlooks, placing intrinsic value on crypto is much more difficult.

We believe that crypto has more in common with commodities and price outlooks are at least partially driven by market positioning.

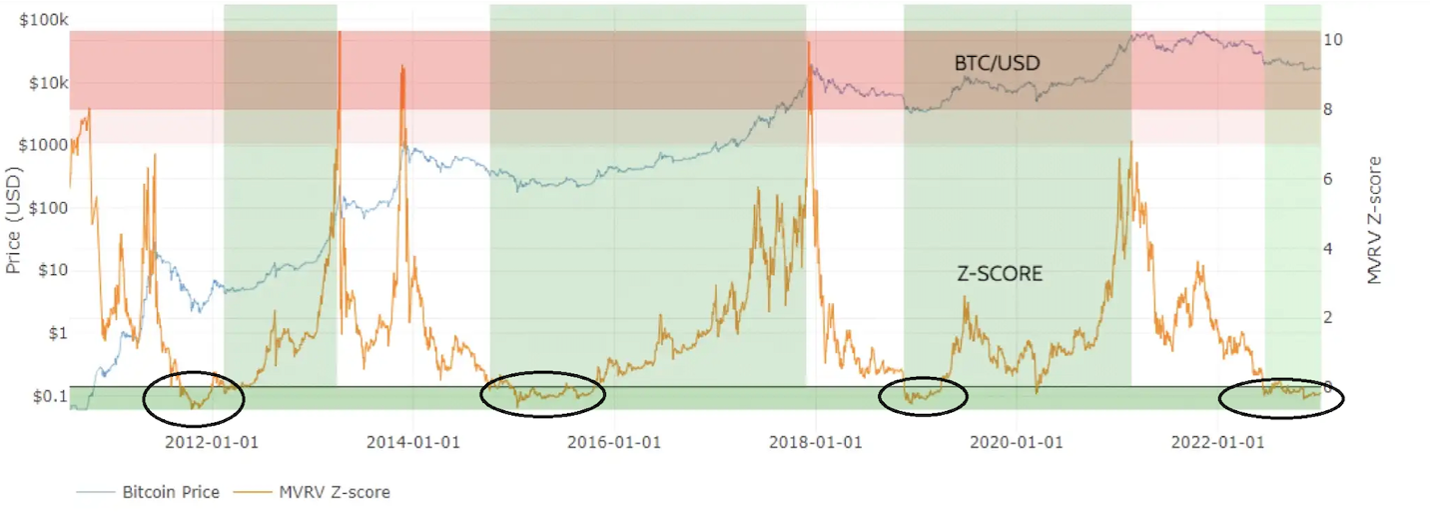

When looking at bitcoin, this market tends to like a ratio called Market Capitalization vs Realized Capitalization ("MCRC"). So, comparing the overall capitalization versus the capitalization of all of the coins based on their last trade price.

Unlike fiat currency, the openness of the blockchain allows us to see this ratio in a transparent way. Looking at the below chart, we can see the MCRC has traded in a range of 0 and 7. Below 1, the coin is considered undervalued and above 4, it is overvalued.

We began this year at 0, or in technical terms it was significantly oversold. Whether you believe in this technical signal or not, it seems to be a factor getting a lot of attention in the rally.

Source: Glassnode

We will keep an eye on some of the key technical drivers and share when we think there is something significant to be aware of. There will be other factors that drive crypto prices such as regulation, new applications and a growing user base. Technical indicators will always be relevant for the major crypto coins, giving us insight into when the market is oversold or overbought. If you follow the MVRV, it has been an effective indicator for bitcoin momentum.

Momentum can change quickly but after a tough 2022, it is clear that investors are seeing value in crypto.

Check back regularly for further updates on our Blockchain Yield Blog.